About The Bond

Voting Resources and Links

VOTE Early

Voting

OCT. 20 - OCT. 31

Election Day

Tuesday NOV. 4

Join us in making a difference in our community and in the lives of our students, parents, and teachers by VOTING FOR the Snyder ISD bond election.

This bond package was created by a diverse group of local residents and taxpayers who carefully evaluated the needs of the school district.

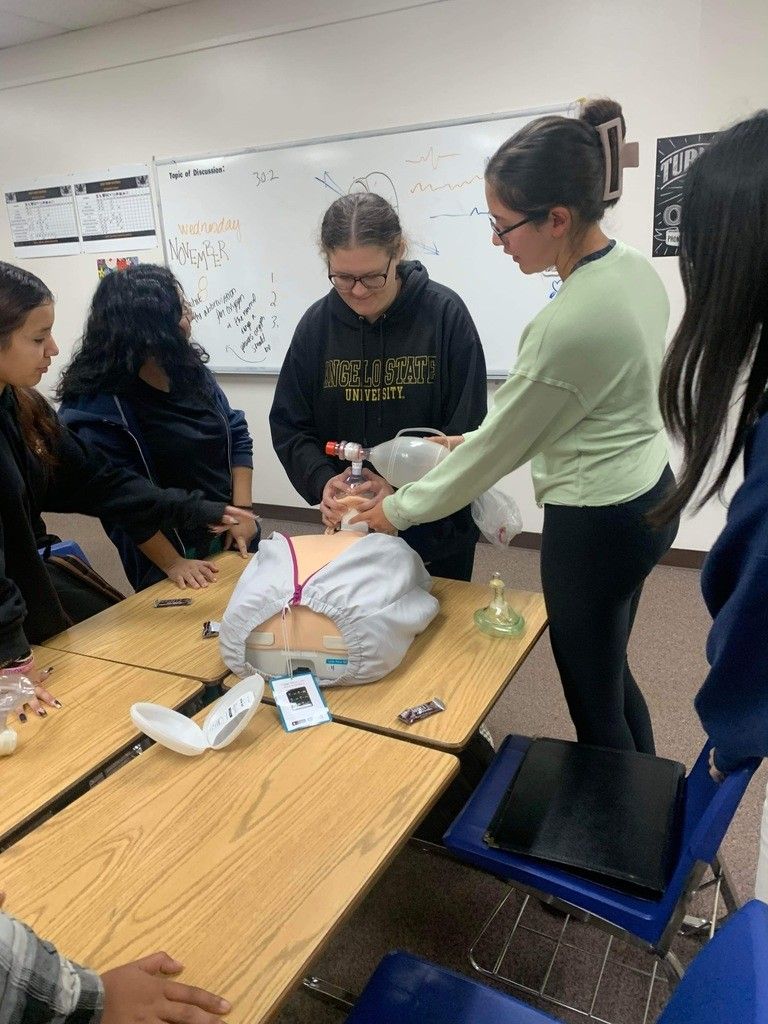

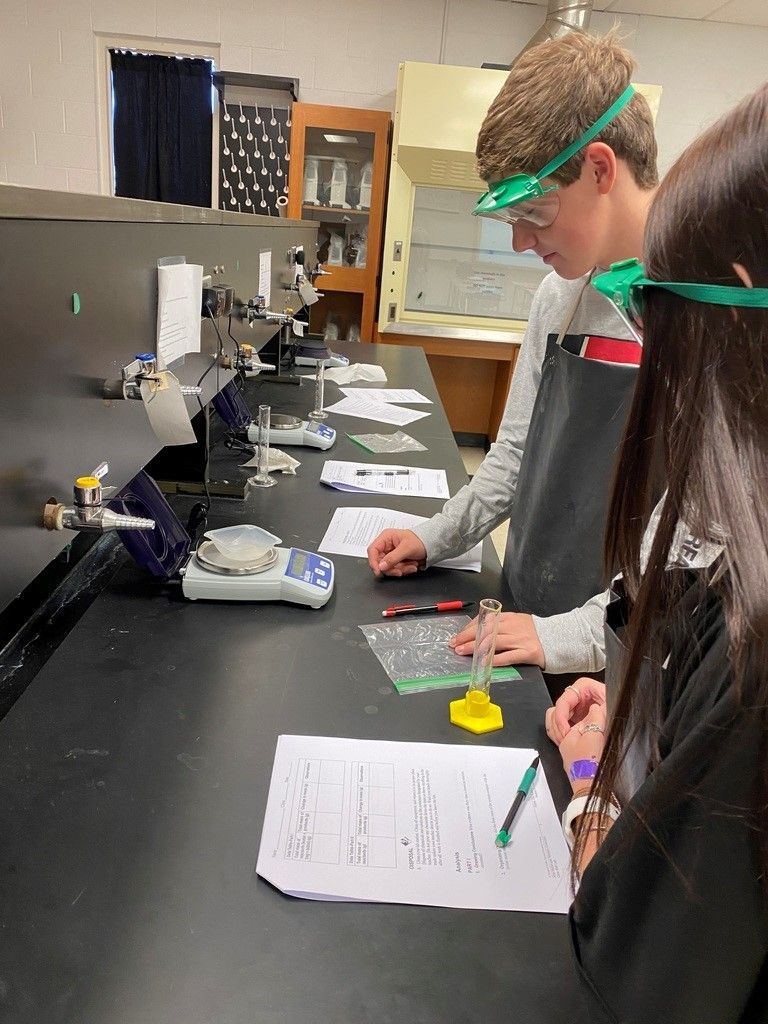

Investing in our aging facilities will ensure that we provide high-quality learning environments and unique educational opportunities that prepare our students for the future.

Snyder ISD is the heart of our community, and our students and teachers deserve the very best. Help leave a lasting legacy by voting for a plan that will positively impact our kids, our community, and OUR FUTURE!

Get Involved

Get Involved and Make a Difference

Contact Us

We will get back to you as soon as possible.

Please try again later.

Passing the school bond means safer classrooms and better resources for our children’s future.

Parent

Request a Yard Sign

Yard Sign Request

Thank you for requesting a yard sign. A member of the PAC will reach out to you with details.

Please try again later.

PAC Events

December 2025

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

1

2

3

4

Taxable Value Breakdown

Tax Rate History

The school district’s tax rate has two parts: Maintenance & Operations (M&O) and Interest & Sinking (I&S). M&O pays for everyday expenses like teacher salaries, utilities, and classroom supplies. I&S can only be used to repay bonds for building and renovating schools or other major projects—similar to a mortgage payment. By law, money from one side cannot be used for the other.

Region 1 Comparison

65 and Older Homestead Exemption

Property owners aged 65 and older can file an exemption for school district taxes. Upon filing, no matter the school district’s tax rate, nor the value of your property, your taxes to your school district have a ceiling also known as a freeze.

- Your dollar amount owed will never exceed that ceiling from the date the exemption is granted.

- If improvements are made to your homestead in the future, your ceiling may increase but only for the improved section’s value (i.e. pool, barn, addition).

The impact of the bond will have no effect to individual’s homestead tax ceiling that are aged 65 and older

Proposition 11 will be on the November 2025 ballot.

If passed, would increase the homestead property tax exemption for residence of persons who are disabled or 65 years or older from $10,000 to $60,000 of the market value of the home.

This addition would effectively increase the exemption for disabled or 65 years or older to $200,000 if Proposition 13 also passes.

If the bond passes, the new frozen levy from 2025 will be in effect prior to the new bond tax rate.

STRONGER SCHOOLS

STRONGER SNYDER

About The Bond

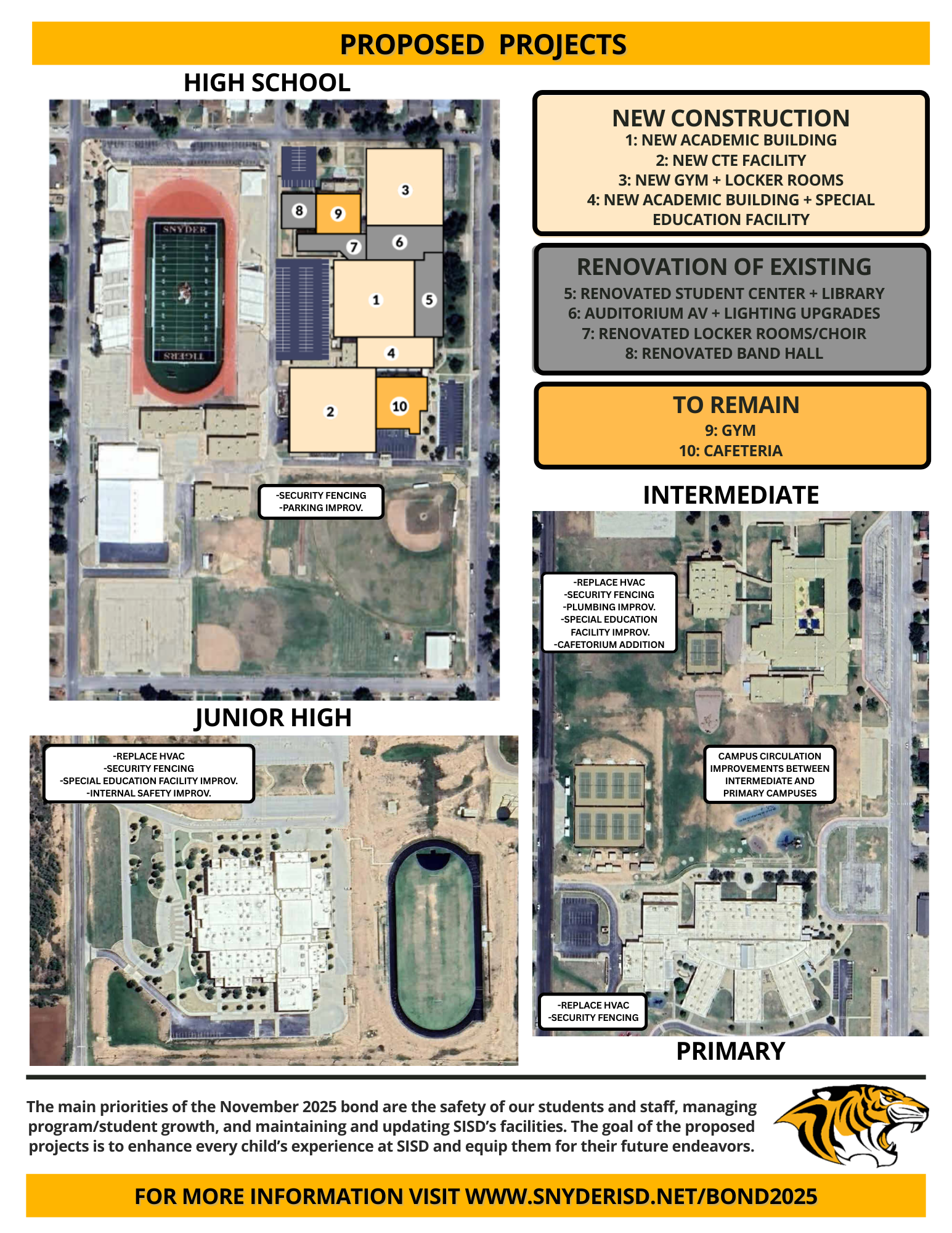

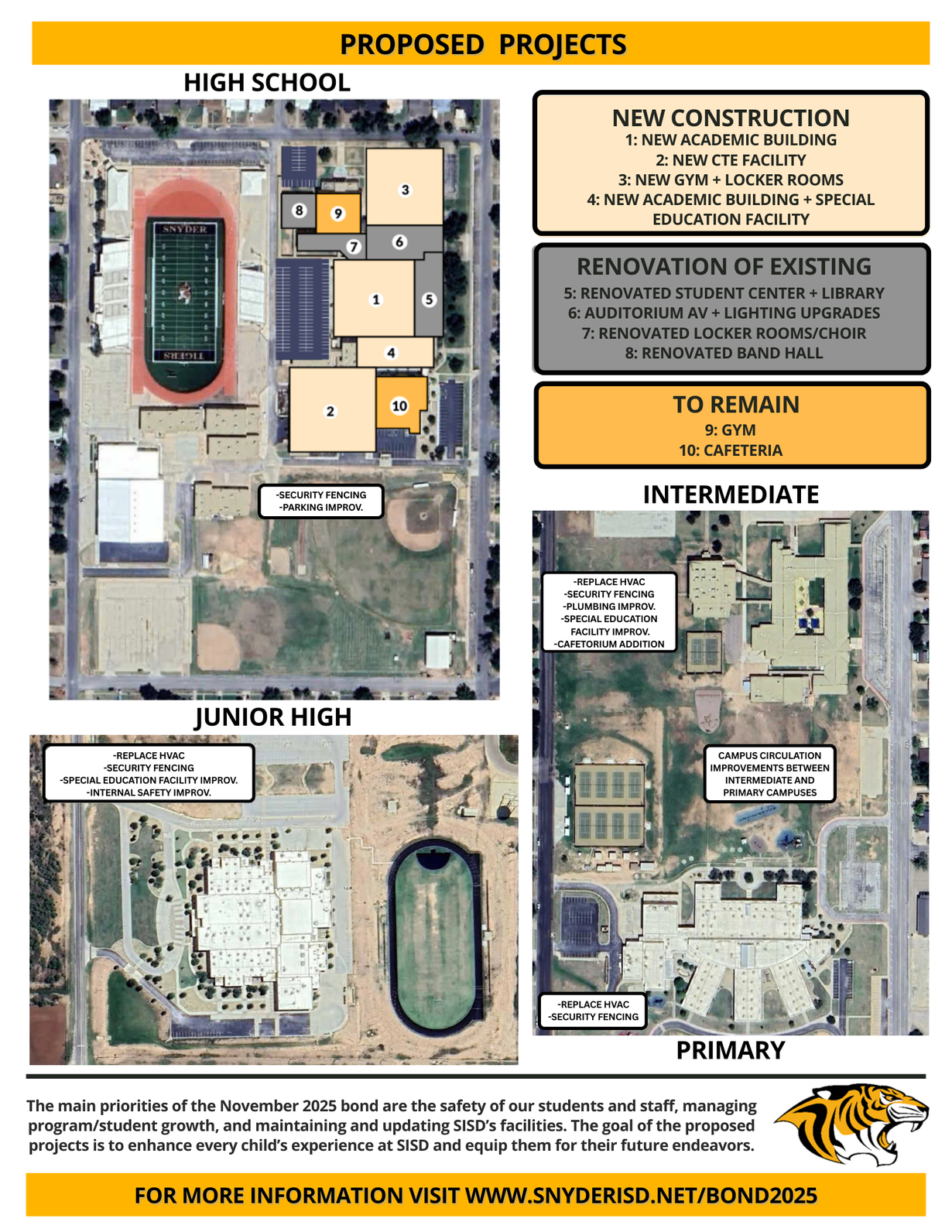

Proposed Project Map

Voting Resources and Links

Get Involved

PAC Events

VOTE

Early Voting

OCT. 20 - OCT. 31

Election Day

Tuesday NOV. 4

Join us in making a difference in our community and in the lives of our students, parents, and teachers by VOTING FOR the Snyder ISD bond election. This bond package was created by a diverse group of local residents and taxpayers who carefully evaluated the needs of the school district. Investing in our aging facilities will ensure that we provide high-quality learning environments and unique educational opportunities that prepare our students for the future. Snyder ISD is the heart of our community, and our students and teachers deserve the very best. Help leave a lasting legacy by voting for a plan that will positively impact our kids, our community, and OUR FUTURE!

Get Involved and Make a Difference

Contact Us

We will get back to you as soon as possible.

Please try again later.

Passing the school bond means safer classrooms and better resources for our children’s future.

Request a Yard Sign

Yard Sign Request

Thank you for requesting a yard sign. A member of the PAC will reach out to you with details.

Please try again later.

Finance Facts

Why Passing the School Bond Matters

Tax Impact Table

Taxable Value Breakdown

Tax Rate History

Region 1 Comparison

65 and Older Homestead Exemption

Tax Calculator

The school district’s tax rate has two parts: Maintenance & Operations (M&O) and Interest & Sinking (I&S). M&O pays for everyday expenses like teacher salaries, utilities, and classroom supplies. I&S can only be used to repay bonds for building and renovating schools or other major projects—similar to a mortgage payment. By law, money from one side cannot be used for the other.

Property owners aged 65 and older can file an exemption for school district taxes. Upon filing, no matter the school district’s tax rate, nor the value of your property, your taxes to your school district have a ceiling also known as a freeze.

- Your dollar amount owed will never exceed that ceiling from the date the exemption is granted.

- If improvements are made to your homestead in the future, your ceiling may increase but only for the improved section’s value (i.e. pool, barn, addition).

The impact of the bond will have no effect to individual’s homestead tax ceiling that are aged 65 and older

Proposition 11 will be on the November 2025 ballot.

If passed, would increase the homestead property tax exemption for residence of persons who are disabled or 65 years or older from $10,000 to $60,000 of the market value of the home.

This addition would effectively increase the exemption for disabled or 65 years or older to $200,000 if Proposition 13 also passes.

If the bond passes, the new frozen levy from 2025 will be in effect prior to the new bond tax rate.

Supporting the bond secures essential resources for our schools and strengthens our community’s future.

The main priorities of this bond are the safety of the students and staff, managing program/student growth, and maintaining and updating Snyder ISD facilities.

Modern Facilities

Enhanced Education

Community Growth

Economic Impact

Building Stronger Schools, Brighter Futures

How the Bond Benefits Our Community

Lauren Collier

Melissa Sorrells

Mark Rodriquez

Joni Gonzales

Hayden Hayes

Ryan Mitchell

Michelle Bird

Patrick Shneider

Luann Burleson & Thomas Strayhorn

Jason Cave

Updated Schools and facilities will attract new families to Snyder ISD

and provide students with unique and varied learning experiences that are not available in surrounding districts.

Frequently Asked Questions

What is the school bond?

A local funding measure to improve school facilities and resources.Why is passing the bond important?

It ensures safe, modern schools that support student success.How will the bond funds be used?

Funds will upgrade classrooms, technology, and safety features.How do I vote on the bond?

Vote at your local polling place or by mail before the deadline.